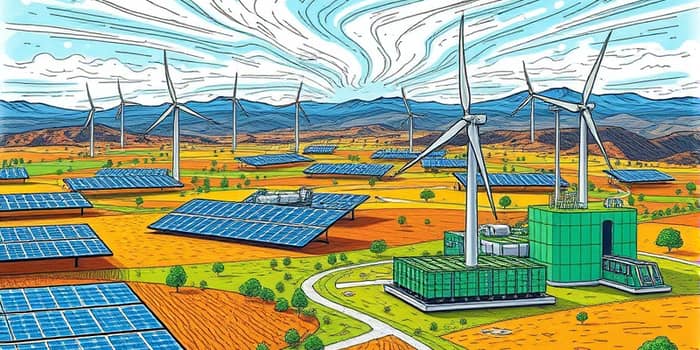

The global energy landscape is undergoing an unprecedented transformation. From the sun-drenched deserts hosting photovoltaic arrays to offshore wind farms harnessing ocean breezes, the shift towards renewable energy is both visible and measurable.

Economic forces, technological breakthroughs, and environmental imperatives are converging to accelerate this change. The result is a profound reorientation of investment flows, regulatory frameworks, and market dynamics.

The energy transition reflects a significant shift towards renewable energy driven by the need to reduce carbon footprints and ensure sustainable growth. Governments, corporations, and individuals alike are rethinking traditional models.

Advancements in solar photovoltaics, wind turbine design, and hydrogen production are enabling clean power to compete head-to-head with legacy fossil fuel sources. This competitive edge is reshaping the energy marketplace.

Financial commitments to clean energy technologies are surging. In 2025, investments in renewables are projected to exceed upstream oil and gas spending for the first time, reaching an estimated $670 billion.

This level of capital allocation signals a new era of market priorities. Investors are recognizing the long-term profitability and resilience of renewable assets, even amid fluctuating commodity prices and geopolitical tensions.

Strong policy frameworks have been instrumental in catalyzing the energy transition. The U.S. Inflation Reduction Act alone has earmarked nearly $400 billion to clean energy incentives, tax credits, and research grants.

These measures have fostered domestic manufacturing growth, particularly in solar panel production and battery assembly, creating jobs and strengthening supply chains.

Meanwhile, regulatory reforms in Europe, Asia, and Africa are streamlining environmental assessments and grid connection processes, which had previously posed significant bottlenecks.

Renewable generation is scaling at an extraordinary pace. In 2024 alone, at least 620 GW of new solar and wind capacity came online, surpassing many forecasts.

Solar photovoltaics are slated to meet half of the incremental global electricity demand through 2025, thanks to rapidly declining technology costs and innovations such as bifacial panels and perovskite cells.

Wind energy, both onshore and offshore, is benefiting from turbine size increases and improved aerodynamics, boosting capacity factors and lowering levelized costs of energy.

Energy storage is the linchpin of a reliable, low-carbon grid. Long-duration energy storage installations are expected to double in the next two years, addressing the intermittency of wind and solar power.

Battery energy storage systems (BESS) are projected to overtake pumped hydro storage in total installed capacity, reflecting a shift towards modern energy storage technologies that offer modularity and rapid deployment.

These systems enhance grid flexibility, provide ancillary services, and reduce the need for fossil fuel peaker plants.

Geographically, the energy transition is redistributing influence. Traditional hydrocarbon exporters are increasingly competing with regions that host the majority of renewable resource potentials.

China leads in deployment efficiency, adding nearly twice as many gigawatts per dollar as the U.S., highlighting variations in financing costs and supply chain integration.

The European Union continues to showcase how sustained climate policies and economic growth can coexist, with emissions dropping while GDP expands.

Despite robust growth, challenges remain. Lengthy permitting and interconnection delays can stall critical projects, while supply chain disruptions may affect component availability.

Skilled workforce shortages in emerging technologies and uneven regional policies also pose hurdles. Yet, these obstacles present opportunities for innovation in project financing, modular construction, and workforce training.

Furthermore, the rising demand from data centers and digital infrastructure creates new markets for flexible renewable supply and storage solutions, potentially stabilizing grid prices and enhancing energy security.

Looking ahead, the energy transition offers a pathway to decarbonization, economic resilience, and sustainable development. By aligning investments, policies, and technological innovation, stakeholders can realize a cleaner, more resilient energy system that benefits people and the planet.

References